One of the greatest things about term life insurance is that many life insurance companies offer it. This abundance of insurers in the marketplace benefits insurance shoppers because having so many carriers to choose from creates intense competition for insurance companies offering low-cost term life insurance.

Easy Article Navigation

- Best Overall: Protective Life Insurance

- Best for Customer Satisfaction: Banner Life

- Best Product Selection: Lincoln National Life

- Best for Applicant Underwriting: Prudential

- Best for Optional Riders: Corebridge Financial

- Best for Accelerated Underwriting: Symetra Life Insurance

- Best for Financial Stability: Pacific Life Insurance Company

- How to Choose the Best Term Life Insurance Company

- Frequently ask Questions

But, it’s also important to point out that an abundance of companies with multiple types of term life insurance plans can create an abundance of confusion for consumers trying to sift through all the available plans.

For this reason, this article is available to help insurance shoppers make an informed decision regarding the best term life insurance companies.

The 7 Best Term Life Insurance Companies

Consumers can have comfort knowing that all life insurance companies are heavily regulated and annually rated by various national rating services like A.M. Best.

As with any industry, however, some carriers excel in particular categories, and it’s helpful to know which categories a company being considered does best in.

For example, Company A may have the lowest rates for a particular policy type but drag their feet when paying a claim. Or, Company B might deliver outstanding customer service but skimps on the optional riders they offer.

Here are our best term life insurance companies and where we believe they excel:

- Protective Life Insurance

- Banner Life Insurance

- Lincoln National Life

- Prudential

- Corebridge Financial

- Symetra Life Insurance Company

- Pacific Life Insurance Company

Best Overall: Protective Life Insurance

With over a century’s worth of experience, Protective has found how to succeed in virtually every category. The company delivers a comprehensive product selection, ultra-competitive rates, and outstanding customer service.

Similar to many of the large and well-established national insurance companies, Protective employs five subsidiary companies to make certain that its products are effectively distributed throughout the country.

Each of Protective’s subsidiary companies also stands on its own when it comes to financial stability and a positive outlook going forward. Since a life insurance contract is a promise to pay in exchange for a premium, it’s important for consumers to know that their selected carrier can keep that promise for decades.

| Company | A.M. Best | S&P Global | Fitch | Moody’s |

|---|---|---|---|---|

| Protective Life | A+ | AA- | A+ | A1 |

| West Coast Life | A+ | AA- | A+ | A1 |

| MONY Life | A+ | A+ | A+ | A1 |

| Protective Life & Annuity | A+ | AA- | A+ | – |

| Protective P&C | A | – | – | – |

Pros:

- Competitive pricing for substandard health classes

- Term policies can be converted to permanent policies

- Offer 35 and 40-year level term policies

- Policies are renewable up to age 90

Cons

- Limited non-medical underwriting options

- Much higher rates for smokers and smokeless tobacco users

- Slower than many companies for application approval

Key features of Protective’s Term Life Insurance Policies:

- Super-Competitive Rates

- Coverage amounts up to $50 million

- Living benefits via Terminal Illness rider

Best for Customer Satisfaction: Banner Life

Rated AA or better by the national rating services, Banner Life is a top performer for its holding company, Legal & General America. Currently licensed in DC and all other states but New York, Banner’s management has invested a lot of time and effort in Customer Service and Claims Services to become our overall favorite in the category.

Banner also falls constantly in the top five carriers when it comes to the lowest rates for term life insurance. They offer policy terms of 10, 15, 20, 25, 30, 35, and 40 years. And, unlike many companies, Banner will offer a term policy up to age 75, and all policies are convertible to permanent life insurance.

While an accelerated death benefit rider is offered by most national insurers, Banner includes this valuable living benefit in its term policy at no additional charge.

For insurance shoppers who pay special attention to a company’s financial ratings, Banner comes in with an A+ rating from A.M. Best and an AA- from Standard & Poor’s. And when it comes to our customer satisfaction category, Banner Life drew fewer complaints than many of the other insurers their size.

Simply put, we, as an independent agency representing many of the highest-rated life insurance companies, put Banner LIfe at the top when it comes to customer satisfaction.

Pros:

- 35 and 40-year term policies available

- Consistently listed in the top 5 for lowest rates

- Outstanding customer and claims service

- Offers temporary coverage for qualified applicants

- Offers no medical exam life insurance option

Cons:

- A maximum face amount of $1,000,000

- Accelerated Death Benefit not included

- Does not offer Whole Life insurance

Key features of Banner Life’s Term Life Insurance Policies:

- Super-Competitive Rates

- Accelerated underwriting for quick policy issue

- Unique laddering of coverage rider

Best Product Selection: Lincoln National Life

Founded more than a century ago, Lincoln National Life is the cornerstone company for the Lincoln Financial Group of companies.

Although Lincoln is always in the top 10 for outstanding life insurance products, it also has a stellar reputation in providing products for retirement planning and wealth accumulation and protection.

With its stellar reputation, Lincoln National Life lives up to its namesake, Abraham Lincoln, the 16th President of the United States of America.

Moreover, Lincoln Financial’s success in the financial industry allows the company to provide considerable grants for more than 300 nonprofits annually.

Consumers who are considering Lincoln National products will be please to know that the insurance company earns very high ratings from each of the national rating services year over year.

The company’s current ratings demonstrate that the company will keep its promises to policyholders whenever a claim for benefits is filed:

Lincoln National offers two formidable term products that are competitively priced and backed by a century-old financial powerhouse.

Lincoln TermAccel Level Term – This product is considered a simple issue product and has super-competitive rates for individuals under 50 years old that require face amounts of $1,000,000 or less. The company uses a simple phone interview application and provides fast processing that can deliver approvals in just a few days if no testing is required.

Lincoln LifeElements Level Term – Lincoln’s LifeElements product is targeted at individuals 30 years old and older who require a death benefit of $1,000,000 and above. This product also uses a telephone interview rather than the standard paper application, so the applicant can be processed and approved as quickly as possible.

Additionally, both term products can be customized for the applicant using the most popular optional riders:

- Accelerated Death Benefit Rider

- Children’s Term Rider

- Waiver of Premium

Both TermAccel and LifeElements can be converted to permanent policies without a medical underwriting requirement.

Pros:

- Large selection of Term and permanent cash-value products

- Streamlined underwriting process that delivers rapid policy decisions

- Online applications with an average approval time of fewer than 21 days

- Liberal and competitive underwriting guidelines for applicants with various health conditions

- No medical exam policies available for healthy non-smokers

Cons:

- Lincoln National does not offer whole life insurance.

- Although claims can be filed online, typical service requests cannot be made online.

- Although a children’s term rider is available, you cannot buy a stand-alone policy for a child.

Key Features of Lincoln National Term Life Insurance Policies

- Available death benefits of $1 million +

- Simple phone interview application

- Super competitive rates for 55+ applicants

Best for Applicant Underwriting: Prudential

Ask someone to name three life insurance companies, and it’s likely that Prudential will be one of them. Since being founded in 1875, Prudential has become a behemoth insurance company servicing policyholders around the world.

Prudential’s offers a comprehensive product portfolio with financial products like:

- Term Life insurance products

- Permanent cash-value Life Insurance products

- Indexed and Variable Universal Life Products

- Mutual Funds

- Fixed, Indexed, and Variable Annuities

- Real Estate Brokerage Franchises

- And a large family relocation services division

Without fail, Prudential is one of those companies that demonstrates rock-solid financial stability year after year.

| Rating Service | Company Rating |

| A.M. Best | A+ |

| S&P Global | AA- |

| Moody’s Investors Service | Aa3 |

| Fitch Ratings | AA- |

Prudential Term Life Insurance Products

Term Essential – Prudential’s Term Essential product is traditional term insurance with available policy terms of 10, 15, 20, and 30-years.The premiums remain the same during the life of the policy, and the policy can be easily converted to a permanent product in Prudential’s portfolio. This conversion does not require medical underwriting, so the policyholder will receive the same rate class as the term policy.

As with most term policies in the marketplace, Prudential offers a variety of riders that allow the applicant to broaden the policy’s coverage and get additional living benefits.

Term Elite – Like Term Essential, this policy can last for 10, 15, 20, or 30 years and be customized with valuable riders like the Living Needs Benefit, which will pay out a large portion of the death benefit if a policyholder is diagnosed with a terminal illness. One difference: If you convert a Term Elite policy to permanent coverage within the first five years, you get a one-year premium credit against the cost of the new policy.

PruTerm One – PruTerm One is an annually renewable term product that is commonly purchased to cover short-term financial risks like auto loans, personal loans, or equipment loans for business owners.

Pros:

- A comprehensive selection of Term and Permanent insurance products

- Favorable rates for applicants who are overweight applicants

- Very competitive rates for applicants who are managing diabetes

- Liberal underwriting for applicants who smoke cigars or a pipe or use smokeless tobacco

- A or better ratings from all the rating companies year after year

Cons:

- Minimal selections for no exam life insurance policies

- Prudential does not offer whole life or final expense insurance.

Key Features of Prudential Term Life Insurance Policies

- Conversion privilege available for both term products

- Very competitive rates for applicants dealing with certain health and lifestyle issues

- Offers a short-term annually renewable product for individuals and business owners

Best for Optional Riders: Corebridge Life Insurance

Corebridge Financial is a prominent financial services company dedicated to providing a comprehensive suite of products and services to individuals, businesses, and institutions. With a focus on innovation and customer-centric solutions, Corebridge Financial offers a wide range of investment management, retirement planning, and insurance products designed to meet the diverse needs of its clients.

Corebridge Financial is a prominent financial services company dedicated to providing a comprehensive suite of products and services to individuals, businesses, and institutions. With a focus on innovation and customer-centric solutions, Corebridge Financial offers a wide range of investment management, retirement planning, and insurance products designed to meet the diverse needs of its clients.

The company’s commitment to leveraging cutting-edge technology and data-driven insights ensures that its clients receive personalized and effective financial strategies, helping them achieve their long-term financial goals.

In addition to its robust product offerings, Corebridge Financial is renowned for its exceptional customer service and professional expertise. The company employs a team of highly skilled financial advisors and specialists who work closely with clients to develop tailored financial plans that align with their unique objectives.

Corebridge Financial’s emphasis on transparency, integrity, and trust has earned it a strong reputation in the industry, making it a preferred choice for those seeking reliable and comprehensive financial solutions. Whether it’s planning for retirement, managing investments, or securing insurance coverage, Corebridge Financial is dedicated to helping clients navigate the complexities of the financial landscape with confidence and ease.

Corebridge Financial Ratings

Rating Agency Rating

AM Best A

S&P Global A+

Moody’s A2

Fitch Ratings A

Corebridge Financial offers a variety of term life insurance products designed to meet different needs and budgets. Here’s a brief description of each:

-

Level Term Life Insurance: This product provides a fixed premium and death benefit amount for the entire term of the policy, typically available in terms of 10, 15, 20, or 30 years. It is ideal for individuals seeking predictable and stable coverage for a specified period, such as during the years of a mortgage or while children are dependents.

-

Annual Renewable Term Life Insurance: This product offers coverage for one year at a time, with the option to renew annually. Premiums may increase each year based on the policyholder’s age and other factors. This type of policy is suitable for those looking for short-term coverage with the flexibility to renew as needed.

-

Return of Premium Term Life Insurance: With this product, policyholders pay higher premiums compared to standard term life insurance, but if they outlive the term, they receive a refund of the premiums paid. This option appeals to those who want the security of life insurance coverage with the added benefit of potentially getting their money back.

Corebridge Financial offers several riders that can be added to their term life insurance policies to enhance coverage and provide additional benefits. Here is a brief description of each rider:

-

Accelerated Death Benefit Rider: This rider allows the policyholder to receive a portion of the death benefit if diagnosed with a terminal illness, typically with a life expectancy of 12 to 24 months. It provides financial support during a difficult time, helping cover medical expenses and other costs.

-

Waiver of Premium Rider: If the policyholder becomes totally disabled and is unable to work, this rider waives the premium payments for the duration of the disability, ensuring that the life insurance coverage remains in force without the financial burden of paying premiums.

-

Child Term Rider: This rider provides term life insurance coverage for the policyholder’s children, usually in units of $1,000. It offers a death benefit if a covered child passes away, helping cover funeral costs and other expenses. The coverage can often be converted to a permanent policy when the child reaches adulthood.

-

Accidental Death Benefit Rider: This rider pays an additional benefit if the policyholder dies as a result of an accident. It provides extra financial protection for the policyholder’s beneficiaries in the event of an accidental death.

Pros of Corebridge Financial Term Insurance

-

Flexible Coverage Options: Corebridge Financial offers various term lengths and coverage amounts, allowing policyholders to choose a plan that fits their specific needs and financial goals.

-

Competitive Premiums: The term life insurance policies are often competitively priced, making them an affordable option for many individuals seeking substantial coverage at a reasonable cost.

-

Simplified Application Process: Many policies feature a streamlined application process, sometimes without the need for a medical exam, making it easier and faster to obtain coverage.

-

Riders for Customization: The availability of multiple riders, such as the Accelerated Death Benefit Rider and Waiver of Premium Rider, allows policyholders to tailor their coverage to better meet their individual needs and circumstances.

-

Strong Financial Ratings: Corebridge Financial has solid ratings from major rating agencies, indicating financial stability and reliability, which reassures policyholders about the company’s ability to pay out claims.

Cons of Corebridge Financial Term Insurance

-

Limited Availability of No-Exam Policies: While some policies do not require a medical exam, this option may not be available for all coverage amounts or applicants, potentially limiting access for those seeking higher coverage without a medical exam.

-

Premium Increases on Renewal: For renewable term policies, premiums typically increase upon each renewal, which can make long-term coverage more expensive.

-

No Cash Value: Like most term life insurance policies, Corebridge Financial’s term policies do not build cash value, meaning policyholders do not receive any return on premiums paid if they outlive the term.

-

Riders May Increase Costs: Adding riders to customize the policy can increase the overall cost of the insurance, which might make it less affordable for some individuals.

-

Conversion Limitations: While the Conversion Option Rider allows conversion to a permanent policy, there may be limitations on the types of permanent policies available and the period during which conversion is allowed, potentially reducing flexibility for some policyholders.

Best for Accelerated Underwriting: Symetra Life Insurance Company

Term Life has become the most popular type of life insurance because of the affordable rates for a large death benefit. Term life insurance is a solid solution for growing families that will accumulate considerable debt. It’s especially popular as a method to replace the income of a family’s breadwinners.

Symetra’s term product is affordably priced when compared to other term insurance providers and comes in terms of 10, 15, 20, and 30-year policies that offer guaranteed level premiums for the life of the policy.

With Symetra’s term insurance, policyholders are given the option to convert to a permanent policy or the opportunity to renew coverage at the end of the term to an annually renewable term policy until age 95.

The company also offers a handful of optional riders that will allow applicants to customize a policy to meet their specific needs and budget:

- Accelerated death benefit rider

- Waiver of premium rider

- Children’s term insurance rider

By leveraging advanced data analytics and health information from external databases, Symetra can assess risk and determine eligibility quickly and accurately. This not only reduces the waiting period for policy approval but also simplifies the application process, making it more convenient for applicants.

Accelerated underwriting with Symetra is designed to maintain the same level of thoroughness as traditional underwriting methods while providing a faster and more customer-friendly experience. This approach is ideal for individuals in good health seeking timely and efficient life insurance solutions.

Symetra Insurance Company Ratings

| Rating Agency | Rating |

|---|---|

| A.M. Best | A (Excellent) |

| S&P Global | A+ (Strong) |

| Moody’s | A1 (Good) |

Pros and Cons of Symetra’s Term Life Insurance

The Pros of Symetra Term Life Insurance

-

Competitive Pricing: Symetra offers term life insurance policies at competitive rates, making it an affordable option for many individuals and families.

-

Flexible Term Lengths: The company provides a range of term lengths, typically from 10 to 30 years, allowing policyholders to choose a duration that best fits their needs.

-

Conversion Options: Symetra allows for the conversion of term policies to permanent life insurance without additional medical underwriting, providing flexibility as life circumstances change.

-

Accelerated Underwriting: With Symetra’s accelerated underwriting process, eligible applicants can obtain coverage quickly without the need for a medical exam, making the application process faster and more convenient.

-

Strong Financial Ratings: Symetra holds strong financial ratings from major rating agencies, ensuring reliability and financial stability for policyholders.

The Cons of Symetra Term Life Insurance

-

Limited Availability of Riders: Symetra may offer fewer optional riders compared to some competitors, potentially limiting customization of the policy to fit specific needs.

-

No Online Application for All Policies: While some policies may be available for online application, others might require working with an agent, which could be less convenient for those who prefer a fully digital process.

-

Medical Exam Requirement for Some: Although accelerated underwriting is available, not all applicants may qualify, necessitating a traditional underwriting process with a medical exam.

-

Less Known Brand: Compared to some larger insurance companies, Symetra may be less well-known, which could influence a buyer’s confidence in choosing the company.

Best for Financial Stability: Pacific Life Insurance Company

Pacific Life Insurance Company offers a robust term life insurance product designed to provide policyholders with essential coverage at an affordable cost. This product is ideal for individuals seeking financial protection for a specified period, typically ranging from 10 to 30 years.

Pacific Life Insurance Company offers a robust term life insurance product designed to provide policyholders with essential coverage at an affordable cost. This product is ideal for individuals seeking financial protection for a specified period, typically ranging from 10 to 30 years.

Policyholders can choose the term length that best fits their financial goals and needs. During the term, beneficiaries are assured of a death benefit that helps cover expenses such as mortgage payments, educational costs, and other financial obligations, ensuring the loved ones’ financial security in the event of the policyholder’s untimely death.

One of the standout features of Pacific Life’s term life insurance is its flexibility. The policies come with a range of options and riders that allow policyholders to tailor their coverage to their unique needs. Some available riders include the conversion option, which allows the policyholder to convert their term life insurance to a permanent life insurance policy without undergoing a medical exam.

This can be particularly advantageous as it provides an opportunity for lifelong coverage even if the policyholder’s health deteriorates over time. Additionally, other riders, such as the accidental death benefit and the waiver of premium rider, offer extra layers of financial protection and security.

Pacific Life’s term life insurance policies are also known for their competitive pricing and strong customer service. The company leverages its extensive experience and solid financial foundation to offer term life insurance products that provide excellent value.

Policyholders can benefit from the company’s commitment to delivering personalized service and support throughout the policy’s duration. With an easy application process and a reputation for reliability, Pacific Life ensures that securing term life insurance is a straightforward and reassuring experience for its customers.

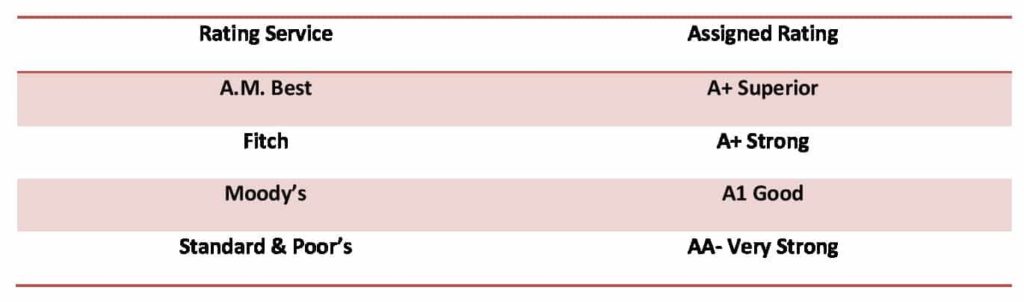

Pacific Life Insurance Company Ratings

| Rating Agency | Rating |

|---|---|

| A.M. Best | A+ (Superior) |

| S&P Global | AA- (Very Strong) |

| Fitch | AA- (Very Strong) |

| Moody’s | A1 (Good) |

These ratings reflect Pacific Life’s strong financial stability and ability to meet its ongoing insurance obligations. The high ratings from these major agencies underscore the company’s solid financial health and reliability in providing life insurance coverage to its policyholders.

Pros and Cons of Pacific Life Term Life Insurance

Pros:

-

Financial Stability and High Ratings: Pacific Life is highly rated by major rating agencies such as A.M. Best, S&P Global, Fitch, and Moody’s, indicating strong financial health and reliability. This provides policyholders with confidence that the company can meet its financial obligations and provide the promised benefits.

-

Flexible Policy Options: Pacific Life offers a range of term lengths and riders, allowing policyholders to customize their coverage to meet their specific needs. Options such as the conversion rider, accidental death benefit rider, and waiver of premium rider add valuable flexibility and additional protection.

-

Competitive Pricing: The company is known for offering competitive rates for its term life insurance policies. This affordability makes it an attractive option for individuals seeking substantial coverage without a significant financial burden.

-

Strong Customer Service: Pacific Life is recognized for its commitment to customer service. Policyholders benefit from personalized support and an easy application process, making the experience of purchasing and maintaining a term life insurance policy straightforward and reassuring.

Cons:

-

Limited Availability of Certain Riders: While Pacific Life offers a range of riders, not all may be available in every state or for every policy. This can limit the ability of some policyholders to fully customize their coverage based on their specific needs and preferences.

-

Medical Exam Requirement: For higher coverage amounts, Pacific Life typically requires a medical exam as part of the underwriting process. This can be a drawback for individuals who prefer a more streamlined application process or who have health conditions that might affect their insurability.

-

No Permanent Coverage: Term life insurance provides coverage for a specific period, and if the policyholder outlives the term, the policy expires with no value. While conversion options are available, they typically need to be exercised within a certain timeframe and might involve higher premiums, which can be a disadvantage compared to permanent life insurance products that offer lifelong coverage.

- Potential Premium Increases upon Renewal: If policyholders wish to extend their coverage beyond the initial term, they may face significantly higher premiums upon renewal. This can make continuing the same level of coverage cost-prohibitive, particularly as the policyholder ages.

By considering these pros and cons, potential policyholders can better assess whether Pacific Life’s term life nsurance products align with their financial goals and insurance needs.

How to Choose the Best Term Life Insurance Company

Choosing the best Term Life Insurance policy will depend a lot on the insurance company you choose. Indeed, term policies among most insurance companies are similar, but some companies do a much better job than others when they design and price their insurance products.

It’s a given that insurance shoppers prefer to get the lowest rate possible. But doing so at the risk of losing outstanding customer service, valuable optional riders, or getting a carrier that doesn’t demonstrate financial stability, is simply not a fair trade-off.

We have listed below eleven aspects a consumer should consider if they are serious about purchasing a policy with the best value and price.

- Are online applications available? Since 21st Century technology plays a large part in the application process, the majority of life insurance companies will allow for applications to be completed and signed online. The electronic application is encrypted for security reasons, and so the data remains more secure than using a paper application, and it’s more convenient for the applicant.

- High customer satisfaction scores. It takes only a few minutes to locate online reviews of life insurance companies. But, be aware, many negative reviews may come from disgruntled former employees. Companies like J.D. Powers, Consumer Reports, and ValuePenquin typically provide reviews that are realistic, and they typically deliver a score based on many reviews from consumers.

- Term Life Conversions. Being able to convert a term policy to a permanent policy is a big deal for two important reasons: 1. Most people will need permanent insurance coverage when they get older, and 2. The ability to purchase a permanent policy through conversion eliminates additional medical underwriting issues.

- Range of term life policy options. If your intention is to keep your term coverage for the longest period possible because of the affordable rates, then look for carriers who offer policy terms longer than 10 or 20 years. Recently, some insurance companies have extended their term policies to 35 and even 40 years and then allow renewals up to age 90.

- Living benefits are offered. When we purchase a term life insurance policy without living benefits, it’s like renting a death benefit that you will likely outlive. The accelerated death benefit option is a valuable option because it will provide living benefits if you are diagnosed with a terminal or critical illness. In fact, some carriers offer this benefit with long-term care coverage built-in. Today, many companies add these living benefits automatically with no additional charge.

- Accelerated death benefits are provided. The ability to use your death benefit if you become critically ill can prevent possible financial devastation. Being able to get an advance on the death benefit paid to you instead of your beneficiary could be essential to helping you manage your illness.

- Competitive pricing options. When you involve an experienced and reputable independent agent in the shopping process, you will get access to many of the top-rated insurance carriers and will have the advantage of shopping your policy needs with multiple carriers simultaneously. Shopping your policy with captive agents that represent and are employed by one life insurance company puts insurance shoppers at a disadvantage.

- Simplified underwriting process. Now that life insurance underwriting has become automated through innovative technology, applicants can have insurance coverage issued in a matter of days rather than weeks or even months.

- Policies are guaranteed renewable. Most insurers allow a term life policyholder to renew their insurance policy up to age 80 or 90 years old. These renewals are generally done annually, and the rate will go up as you age, but if you’ve developed some illnesses and haven’t converted your policy, these annual renewals will become critical for keeping coverage you can afford.

- Policy face amount can be changed. Although term policies once issue have a death benefit that is etched in stone and cannot be changed, many companies allow an applicant to “ladder” coverage so that at certain intervals, your face amount will go down as your need for life insurance coverage decreases over time.

- Temporary insurance is offered. Many companies today will offer temporary coverage to an applicant that will pay the death benefit if you die during the underwriting process or before your policy is issued. The temporary coverage is generally issued on the condition that the insurance company would have ordinarily issued the policy.

Need Help Choosing the Best Term Life Insurance Company for Your Needs?

To find the best Term Life Insurance Company that will provide you with the coverage you need at a price you can afford, contact LIfeInsure.com at 866-868-0099 to speak with an insurance professional who represents most of the top-rated companies in the life insurance marketplace. Alternatively, you can use our instant quote format the bottom of the page.

Term Life Insurance Quotes

Frequently Asked Questions

There are two main types of life insurance: term life insurance, which provides coverage for a specific period of time, and permanent life insurance, which offers lifelong protection along with a cash value component.

The amount of life insurance coverage you need depends on factors such as your income, debts, expenses, and future financial goals. An insurance agent can help you calculate an appropriate coverage amount.

Life insurance riders are additional provisions that can be added to a policy to customize coverage. Examples include accelerated death benefits, waiver of premium, and accidental death benefits.

To find the best life insurance policy, consider your financial needs, compare quotes from multiple insurers, and work with a licensed insurance agent who can help you understand your options.

Not necessarily. Some insurers offer no-exam life insurance policies that allow you to skip the medical exam in exchange for higher premiums. It’s important to compare the options available to you.

Last Updated on October 28, 2024 by Richard Reich