There are many different types of life insurance coverage available, each with its own set of benefits and drawbacks. Indexed universal life insurance (IUL) is one option that combines the flexibility of universal life with the potential for higher growth in the cash value account.

IUL gives policyholders the opportunity to benefit from positive stock market performance while limiting their downside risk. Whether or not IUL is the right choice for you depends on your individual needs and financial goals.

When shopping for life insurance, it’s important to understand all the different options available. Indexed universal life (IUL) policies are a popular choice, but they come with more complicated terms and conditions than other types of life insurance. Before buying an IUL policy, be sure to do your research and compare all the different fees and forecasts.

Indexed universal life insurance is an excellent choice for permanent life insurance coverage. It offers a cash value account that accumulates tax-deferred and is tied to one or more stock indexes, such as the S&P 500. This provides greater potential for growth than other types of universal life insurance, which earn money based on market interest rates.

IUL offers many of the same benefits as a universal life policy, including flexible coverage and the ability to adjust premiums and death benefits. However, IUL also has some unique benefits that make it an attractive option for many people.

Indexed universal life insurance is similar to universal life insurance, but with some key differences. With indexing, your premium payments are based on an index, such as the S&P 500, which can help to maximize your investment growth potential.

Additionally, part of your premium payment goes toward the cost of insurance (covering your death benefit), while the rest is added to your cash account. This provides you with lifelong coverage and the opportunity to grow your investment over time.

Similar to Universal Life, IUL policies have an adjustable premium, which means that you can increase or decrease your payments at any time. This can be helpful in times of financial hardship, or when your needs change. Additionally, the death benefit on an IUL policy is also adjustable but you may have to go through the underwriting process depending on the company and amount of additional death benefit you require.

The cash account in your policy earns money predicated on the performance of your selected stock index. A stock index, such as the S&P 500 or Dow Jones Industrial Average, is a way to track a group of stocks.

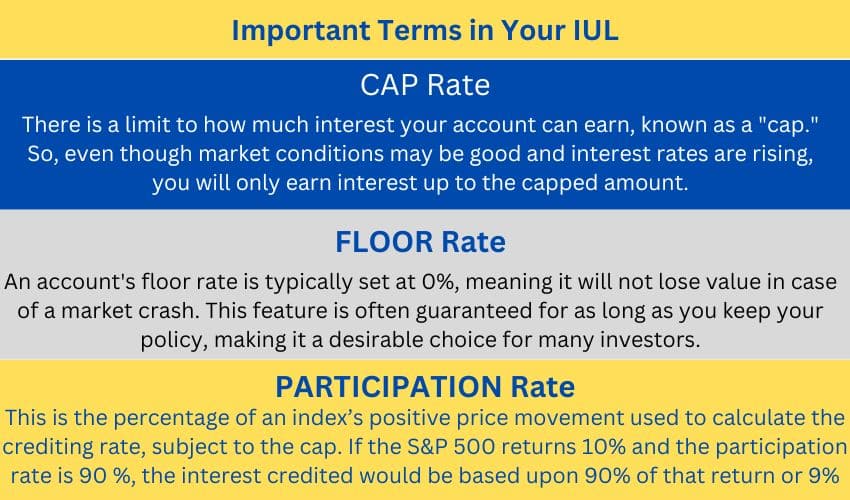

Insurance companies have one or more of these indices you can choose from. The insurer pays interest to policyholders based on the index’s performance subject to the policy Cap — as value goes up, the account earns interest.

However, if an index loses money your cash account is protected by the policy’s floor rate (typically zero or higher) which means your cash account will not lose money like a traditional investment account.

Advantages

Disadvantages

If you’re looking for inexpensive life insurance to replace your income and pay off debts and the family mortgage, an IUL policy is not likely the best choice for you. In these types of cases, Term Life Insurance would be a better fit.

However, if you’re looking for an investment product that can create significant wealth and provide a tax-exempt supplement to your retirement income from other investment products, an IUL can deliver that income and provide a death benefit for your surviving loved ones.

An IUL is a great way to fund your Life Insurance Retirement Plan (LIRP),

Although most IUL policies contain a floor rate of 0%, your cash value account can be impacted by administrative expenses and other costs.

With an IUL, part of your premium payment goes toward the cost of insurance (covering your death benefit), while the rest is added to your cash account. Your cash accounts earns interest based on the performance of the index you’ve chosen. Your cash account funds are not directly invested in the market but rather, linked to its performance.

Most insurers will offer a broad selection of indexes for you to choose from and your insurance professional can advise each company’s performance over time.

IUL is a good fit for individuals who are most concerned about accumulating tax-deferred interest over time as part of their retirement strategy. Especially those individuals who want to bypass the governmental constraints on traditional retirement products.

LifeInsure.com® is a registered

trademark of Intramark Insurance,

Services, Inc. © 2024.

Privacy Policy

Legal Notice & Disclaimer

Here is the legal information we’re required to provide you. LifeInsure.com, a California corporation and subsidiary of Intramark Insurance, is a licensed independent insurance broker. The information provided on this site has been developed by LifeInsure.com for general informational and educational purposes. We try hard to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.