Medicare is the biggest health insurance program in the United States, covering over 62 million Americans. Most individuals getting ready to enroll in Medicare ask the same question: “What is Medicare?”

Medicare is a federal program designed to help seniors 65 and older and people with certain disabilities and medical conditions. It ensures that these folks can get the healthcare they need.

This guide will cover everything you need to know about Medicare. We’ll discuss each part, how to qualify, and the benefits. This information is great for those nearing Medicare age or helping a loved one.

Key Takeaways:

- Medicare is the largest health insurance program in the United States, covering over 62 million Americans.

- It is a federal health insurance program that provides coverage for seniors aged 65 and older, as well as certain individuals with disabilities and certain medical conditions.

- This comprehensive guide will help you understand how Medicare works, its different parts, eligibility requirements, and the benefits it offers.

- By gaining a thorough understanding of Medicare, you can make informed decisions about your healthcare coverage.

- Explore the additional resources provided to enhance your understanding of Medicare and navigate the healthcare landscape more effectively.

Understanding Medicare: An Overview

To understand Medicare, let’s look at its main features. We will cover its history, goals, and what it includes.

Medicare is a health insurance program established in 1965. It helps seniors over 65, people with disabilities, and those with specific illnesses. The program is managed by the Centers for Medicare & Medicaid Services. This is part of the U.S. Department of Health and Human Services.

This program plays a vital role for many Americans. It ensures they can afford healthcare. Medicare covers things like hospital stays, doctor visits, and the cost of medicines.

The plan has various sections that offer different benefits. Together, they provide a full package of health care.

- Medicare Part A: Hospital Insurance

- Medicare Part B: Medical Insurance

- Medicare Part C: Medicare Advantage

- Medicare Part D: Prescription Drug Coverage

Medicare Part A helps with hospital visits and similar care. Part B covers doctor’s office visits and necessary medical items. Both A and B help a lot with common healthcare needs.

Part C, also called Medicare Advantage, allows you to get care from approved private insurers. These plans might include extra benefits like dental or vision care.

Medicare Part D is just for prescription drugs. It helps you pay for necessary medicines. You can get this plan on its own or as part of a Medicare Advantage plan.

Knowing how the parts of Medicare fit together is key. This knowledge helps you make smart choices about your health coverage. In the next sections, we will examine each piece in more detail, including costs and how to sign up.

Medicare Parts A and B: Original Medicare

Medicare is divided into several parts, each with its own role. Original Medicare includes Parts A and B. It’s important to know what they cover, how much it costs, and how to join. This knowledge allows people to get needed medical help.

What is Medicare Part A?

Part A helps with hospital stays, skilled nursing care, and some home health. It also covers hospice for those with serious illnesses. Normally, you don’t pay a premium for Part A if you’ve paid enough in Medicare taxes.

What is Medicare Part B?

Part B covers doctor visits, preventive care, medical supplies, and some mental health services. You pay a monthly premium for Part B, which can be deducted from your Social Security checks.

Enrollment in Original Medicare

If you get Social Security or Railroad Retirement benefits, you’re signed up automatically. Others need to join during specific times, like the Initial Enrollment Period. Doing this prevents extra fees for joining late.

Below is a table with more info on Parts A and B:

| Medicare Part | Coverage | Costs | Enrollment | Additional Information |

|---|---|---|---|---|

| Part A | Inpatient hospital care, skilled nursing facility care, hospice care, limited home health services | No monthly premium for most beneficiaries, but deductibles and coinsurance apply | Automatic enrollment or during initial enrollment periods | Provides coverage for essential inpatient healthcare services |

| Part B | Outpatient medical services, doctor visits, preventive care, medical supplies | Monthly premium, deductibles, coinsurance, and copayments apply | Automatic enrollment or during initial enrollment periods | Covers a wide range of outpatient healthcare services |

Medicare Part C: Medicare Advantage Plans

Medicare Part C, or Medicare Advantage, is an optional choice outside of Original Medicare. These plans are offered by private insurance companies that are Medicare-approved. They add extra coverage to what Medicare Parts A and B offer. For example, you might get help with prescription drugs, eye care, dental work, or hearing aids.

Choosing Medicare Advantage means you get your Medicare from a private company, which can be better for you than getting it directly from the government. A big plus is that these plans can give you more benefits besides covering what Original Medicare does. What you get extra depends on the specific plan and insurance company.

One main plus of Medicare Advantage plans is they often cover prescription drugs, too. You usually won’t need a separate Medicare Part D plan for drugs. This can simplify how you manage your health care.

| Advantages of Medicare Advantage Plans | Differences from Original Medicare |

|---|---|

|

|

Medicare Advantage plans have specific times when you can sign up, like Original Medicare. The first chance you have is three months prior to you turning age 65 and three months after. You can also make changes during the year’s open enrollment time or other special times if you qualify.

Medicare Part D: Prescription Drug Coverage

Prescription drug coverage is vital under Medicare. Medicare Part D ensures people have the drugs they need. It helps control the prices of prescription medicines.

How Medicare Part D Works

Medicare Part D is for those eligible for Medicare. It comes from private insurance companies approved by Medicare. These plans augment Original Medicare or Medicare Advantage to cover medications.

Signing up for Part D means you’ll pay a monthly fee, an annual deductible, and a share of each drug’s cost. Plan costs and details will differ, so choosing the right one is crucial.

Enrolling in Medicare Part D

There are a few ways to join Medicare Part D:

- Join during your Initial Enrollment Period (IEP), a seven-month window beginning three months before turning 65.

- Or during the Annual Enrollment Period (AEP), from October 15th to December 7th each year, to make changes in coverage.

- Special Enrollment Periods (SEP) are available for specific situations, like losing drug coverage or moving away from your plan’s area.

If you don’t enroll right away and lack other drug coverage, you might face a late penalty.

Understanding Medicare Part D Costs

The price of Medicare Part D depends on the plan and your medications. Key costs include:

- Monthly premium: Your monthly Part D coverage cost.

- Annual deductible: This must be paid before coverage starts if your plan has one.

- Co-pays or co-insurance: Amounts you pay per prescription.

- Coverage gap (donut hole): When drug costs hit a limit, you pay more, but this gap is getting smaller due to reforms.

Formularies and Drug Coverage

Medicare Part D plans come with formularies, lists of drugs, and costs. Check a plan’s formulary to see if your drugs are covered.

Formularies have different tiers, with generic drugs usually the cheapest. Make sure your medications are on the list, and check their tier to estimate costs.

Medicare Part D can provide affordable medication coverage. Knowing how it works, enrolling on time, and checking costs and formularies are key to finding the right plan for you.

Medicare Supplement Insurance: Filling the Coverage Gaps

Medicare Supplement Insurance, or Medigap, is extra coverage for Original Medicare. It helps with costs not covered by Parts A and B. These gaps could make you pay a lot out of pocket. Medigap policies fill in these spaces.

You can get a Medigap plan from private insurance companies. These plans help with coinsurance, co-pays, and deductibles, giving you peace of mind for your health expenses.

These plans only work with Original Medicare, not Medicare Advantage. Signing up can protect you from big medical bills.

How Medicare Supplement Insurance Works

With a Medigap policy, Original Medicare pays its part first. Then, your Medigap plan kicks in to help with the rest. This can lower your medical costs.

All Medigap plans have the same basic benefits. However, each type, like Plan F or G, offers different coverage. Choose the one that best fits your needs.

When picking a plan, consider your health and financial needs. Some plans have higher monthly fees but offer more coverage. Others cost less each month but require more out-of-pocket payments.

Selecting the Right Medigap Plan

It’s important to choose wisely from the many Medigap options. Consider what medical services you might use, and look for a plan that covers those needs.

Also, consider your monthly budget. You need to be able to afford the plan you pick. Not all plans are available everywhere, so check what’s offered in your area.

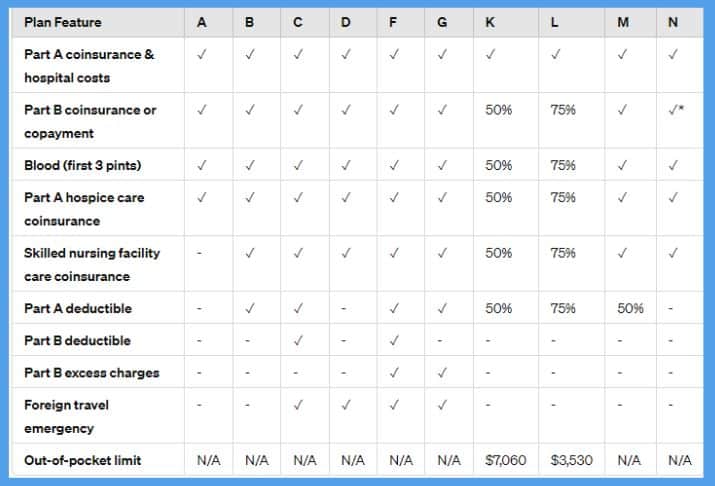

Remember, the cost and choice of plans vary by location. Compare each plan carefully and find the one that best matches your needs and budget. Use the chart below to determine coverages in Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M, and Plan N.

Note:

- Plan N typically requires a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in an inpatient admission.

- Plans K and L have out-of-pocket limits; once these limits are reached along with the Part B deductible, the plan pays 100% of covered services for the rest of the calendar year.

Changes for Plan F after January 1, 2020:

- Plan F and Plan C are no longer available to new Medicare enrollees as of January 1, 2020. Those who were already enrolled in Medicare before 2020 can still enroll in these plans.

- Plan F offers a high-deductible version, which requires paying a deductible amount of $2,700 for 2024 before the plan begins to pay.

Maximum Out-of-Pocket Amounts:

- Plan K has a maximum out-of-pocket limit of $6,220 for 2024.

- Plan L has a maximum out-of-pocket limit of $3,110 for 2024.

Medicare Eligibility: Who Qualifies for Medicare?

Medicare is a federal health insurance program. It provides coverage for qualifying individuals. To get Medicare, you must meet certain criteria.

- Age: Eligibility starts at age 65. For most, this is the key requirement.

- Disability: If you’re under 65, you might qualify for SSDI or RRB disability benefits for 24 months.

- Citizenship: To qualify, you must have been a U.S. citizen or a legal resident for at least five continuous years.

Special health conditions might also affect eligibility. Such as end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

If you’ve ESRD, you could qualify no matter your age. And ALS instantly qualifies you when your disability benefits start.

Remember, just being eligible doesn’t mean you’re enrolled. You have to take steps to join and pick your coverage.

Want more information on Medicare eligibility and how to sign up? Keep reading for a detailed guide, or check out the official Medicare website.

Medicare Enrollment: When and How to Enroll

Knowing when to enroll in Medicare is key for continuous coverage. The process might seem complex, but we’re here to help.

Initial Enrollment Period

The Initial Enrollment Period (IEP) is crucial for most people to join Medicare. It begins three months before your 65th birthday. This span extends to seven months, which includes your birth month and the next three months. You can enroll in Medicare Parts A and B during this time.

Enrolling in your IEP is necessary to avoid late fees. If you’re receiving Social Security benefits, you’ll be automatically signed up for Parts A and B.

Special Enrollment Periods

Missing your IEP means you might join during a Special Enrollment Period (SEP). SEPs offer chances to sign up outside the normal IEP.

Events that could qualify you for an SEP are if you:

- Lose your employer or union health coverage

- Move out of your current plan’s service area

- See another health insurance end

Understanding SEP time limits and deadlines is critical to seize your chance to enroll.

Late Enrollment

Not enrolling during your IEP with no SEP eligibility means you could face penalties. These penalties raise your Medicare Part B monthly costs. The longer you wait, the more you’ll pay.

If you missed your IEP and need to join Medicare, the General Enrollment Period (GEP) is your next option. It happens from January 1st to March 31st yearly. But, expect coverage delays and late fees still apply.

Enrolling in Medicare is vital to securing your health care. Know the enrollment periods, meet the criteria, and sign up on time. Joining during your IEP or with a SEP avoids penalties and ensures a smooth start with Medicare.

Can I Keep seeing My Family Doctor?

Yes, you can generally continue seeing your family doctor under Medicare, but it depends on a few key factors. If your doctor accepts Medicare and participates in the Medicare network, you can continue your care with them without any significant changes. Most doctors do accept Medicare, but it’s important to confirm that your specific doctor is a Medicare provider to avoid any unexpected costs.

When seeing your family doctor under Medicare, understanding potential extra expenses is important. If your doctor accepts Medicare, the costs you incur typically involve standard out-of-pocket expenses such as deductibles, copayments, and coinsurance. For example, after meeting your annual deductible, you might pay 20% of the Medicare-approved amount for doctor visits under Medicare Part B.

Medicare Costs: Understanding Premiums, Deductibles, and Co-payments

Understanding Medicare costs is vital. There are monthly premiums to pay, as well as deductibles and co-payments. Knowing these costs can help you manage your medical budget wisely.

Monthly Premiums

The monthly premium is what you pay for your Medicare coverage each month. The amount varies based on your Medicare part and income. It is crucial to budget for this.

Deductibles

Medicare has deductibles, too. You must pay a certain amount before your coverage starts. Each Medicare part has its own deductible. It’s essential to know these costs to plan your budget.

Co-payments and Coinsurance

Co-payments are fixed costs for specific services or medications. Co-insurance is a percentage of the service’s cost you pay. These can be high for certain services. Be sure you understand your plan’s requirements.

Here’s a table showing cost variations across different Medicare parts:

| Medicare Part | Monthly Premium | Deductible | Co-payments/Co-insurance |

|---|---|---|---|

| Part A | Varies based on work history | $1,632 (in 2024) | Co-pays for hospital stays and certain services |

| Part B | Standard: $174.70 (in 2024) | $240 (in 2024) | 20% coinsurance for most services |

| Part C (Medicare Advantage) | Varies by plan | Varies by plan | Varies by plan |

| Part D (Prescription Drugs) | Varies by plan | Varies by plan | Varies by plan |

Knowing the cost breakdown for each Medicare part lets you better plan your expenses. When picking a Medicare plan, think about what you need and your budget. This ensures you can handle the costs.

Many Medicare beneficiaries find it important to manage out-of-pocket costs. The next section will offer tips and strategies for lowering these costs and using Medicare effectively.

Medicare Coverage: What Does Medicare Cover?

Knowing what Medicare covers is important for making informed choices. We will explore the details of Medicare Parts A, B, C, and D, including what’s covered and services not included in the program.

Medicare Part A Coverage

Medicare Part A, or hospital insurance, covers certain hospital needs. It pays for inpatient stays, skilled nursing care, hospice, and some home care. You can get help with hospital stays and surgeries, and you may need some medical supplies there.

Medicare Part B Coverage

Medicare Part B, or medical insurance, covers doctor visits and some home health services. It also covers check-ups, lab work, and medical devices. Mental health and important screenings like mammograms are also included.

Medicare Part C Coverage

Medicare Part C, or Medicare Advantage, combines A and B, plus more perks. These can be prescription drugs, dental, vision, or hearing care. There are also plans that focus on wellness and health support.

Medicare Part D Coverage

Medicare Part D covers prescription drugs. Private insurers run these plans under Medicare’s approval. Each plan lists its covered drugs, which helps lower the price of medicines.

Services Not Covered by Medicare

While Medicare is wide-reaching, some services are outside its scope. These include cosmetic surgeries, dental and eye care, hearing aids, and most drugs you can buy off the shelf. Understanding these gaps is key to planning your care.

Knowing the scope of Medicare coverage helps you plan your health spending. Always check your coverage and talk to medical professionals to ensure you get all the care you need.

Key Considerations and Additional Resources for Medicare Recipients

If you’re a Medicare recipient, there are crucial things to know. Understanding this will help you get the best out of your healthcare plan. Let’s go over some key points.

Managing Prescription Drug Costs

For many, prescription drugs are a big part of healthcare costs. There are ways to lower these costs. Here’s what you can do:

- Check if your Medicare Part D plan covers your drugs well and is affordable.

- Look into using generic drugs. They can be cheaper but typically work the same way.

- Talk to your doctor about other drug options or ordering drugs by mail to save money.

Accessing Preventive Services

Preventive care is key to staying healthy and avoiding big health issues. With Medicare, you can use these important services:

- Get a yearly checkup to stay on top of your health.

- Have tests done to find diseases like cancer and heart problems early.

- Get medications to prevent certain illnesses.

Understanding Your Rights and Protections

It’s important to know your rights under Medicare. This ensures you get the right care. Learn about these important rights:

- You should always be treated kindly and with respect.

- You have the right to know about your treatment and choose what’s best for you.

- If you disagree with a decision from Medicare or your doctor, you can appeal it.

Additional Resources

If you need more help, there are extra resources available. Here are some options:

- Visit the Medicare website for detailed info on the program, joining, coverage, and saving money.

- The Senior Resource Guide offers many resources. It can help you find local doctors, services, and programs.

- Local Area Agencies on Aging (AAA) provide personalized help to older adults. They offer info on Medicare, long-term care, and other services. Contact your local AAA for more help.

Being well-informed and using these resources helps you confidently manage Medicare. You’ll get the care you need and deserve.

Conclusion

Medicare is essential because it helps seniors and some others get health coverage. Knowing about its parts, who can get it, and how much it costs is crucial. This info helps you choose the right healthcare for you.

Parts A and B, called Original Medicare, are the program’s base. Part C, or Medicare Advantage, adds more benefits and options. Part D covers prescription drugs. If you need more coverage, Medigap can help.

Don’t forget to check out extra help to understand Medicare better. You can learn about eligibility, see different plans, and handle costs. These extra resources can help you pick the best healthcare for your needs.

For more information about Medicare coverage or to get Medicare Supplement plan comparisons, we encourage you to reach out to our Medicare insurance specialists at 866-868-0099 or contact us through our website.

Frequently Asked Questions

Medicare is a federal health insurance program. It’s for seniors and certain individuals. It pays for hospital stays, doctor visits, and drugs.

It gives health insurance coverage to those eligible. There are parts for different services. You can choose from the original Medicare or a plan by private companies.

There are four main parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage plans), and Part D (prescription drug coverage).

Those individuals who are 65 or older can get Medicare. Also, some younger people with disabilities qualify. If you have ESRD or ALS, you might be eligible too.

Enroll during your seven-month initial period. It starts three months before your 65th birthday month. Apply online, by phone, or at your local Social Security office.

These are Part C plans by offered by private companies. They are approved by Medicare. They include more than just Parts A and B, like drug, dental, and vision coverage.

Part D is for prescription drug coverage. It helps with the cost of medicines. Private insurance companies provide this coverage if approved by Medicare.

Last Updated on September 12, 2024 by Sonny O'Steen