Term Life Insurance Quotes

Certainly, most people will agree that Level Term Life insurance is likely the most popular because you can purchase a lot of life insurance at a very low cost.

Yes, whole life insurance has been around much longer, but when it comes to financial needs like replacing your income, paying off a mortgage, or making sure your children can go to college, level term life insurance will be the product of choice.

Easy Article Navigation

- What is Level Term Life Insurance?

- What is the difference between Level Term and Whole Life Insurance?

- How do Level Term Life Policies Work?

- Pros and Cons of Level Term

- Can Riders be used with Level Term Policies?

- Alternatives to Level Term

- Level Term Insurance Rates

- Frequently Asked Questions

In many cases, however, individuals and families think of level term insurance as the policy you buy (or get through your employer) until you are in a position to afford whole life or universal life because these insurance products provide more than just a death benefit.

What is Level Term Life Insurance?

When we consider what level term insurance is, we should first acknowledge that there is more than one kind of term life insurance. Although level term is the most popular type of term insurance, on occasion decreasing term or renewable term is a better choice.

Years back, decreasing term insurance was popular when used to insure a personal debt because the insurance coverage decreased as the debt decreased and the product was a little cheaper than level term.

However, as the term life insurance market became more competitive, consumers found there was no longer a worthwhile saving between decreasing term and level term, and as such, decreasing term became a thing of the past.

Renewable term, however, has the same characteristics as a level term policy except renewable term life insurance has a typical policy period of one year. Renewable term is still sold today but typically only as a method of renewing a level term life insurance policy.

Level Term Life Insurance is the product of choice for many individuals and families who require a lot of coverage at very affordable rates. It is particularly practical for young families who are accumulating a lot of debt that needs to be protected in the event the family’s primary earner dies unexpectedly.

Level Term policies have the following distinctions from all other types of life insurance:

- It is sold in terms (policy period) of typically five years to thirty years

- Once the policy is issued, the premium cannot change during the policy term

- Once the policy is issued, the death benefit remains the same during the policy term

- There is no cash value component that earns interest

- Since term insurance is considered temporary coverage, the rates versus other types of insurance are much lower

What is the difference between Level Term and Whole Life Insurance?

There are many differences between level term life insurance and whole life insurance. In fact, the only thing they have in common is once they’re issued, the premium and death benefit is etched in stone.

Although it’s common knowledge that term life insurance is much cheaper than whole life insurance, the biggest difference between these two life insurance products is the reason a consumer would purchase them.

The Difference between Level Term and Whole Life Insurance:

As we mentioned earlier, why you need life insurance is the most important part of the decision regarding which type of life insurance to purchase.

How do Level Term Life Policies Work?

When compared to cash-value permanent life insurance, Level Term Life Insurance policies are more straightforward and have fewer moving parts.

The unmovable parts of level term life insurance policies are the same with almost every company:

- The death benefit will remain the same over the life of the policy

- The periodic premiums will remain the same over the life of the policy

- The policy expires and the end of the preselected term

- There is no cash value component or interest earned

As with any type of life insurance product, there will be underwriting involved which typically consists of a life insurance medical exam (but not always), an application that contains health and lifestyle questions, and various electronic reports.

You can expect in almost every case that the insurance company will request reports from the Medical Information Bureau (MIB), reports from a Prescription Drug database, and a report of your driving record for the last 3 to 5 years.

Once the underwriting process is complete, the underwriter will assign a health classification to your application and then your insurance rates will be calculated accordingly.

Besides the underwriting information, your rates will also be impacted by the amount of life insurance you’re applying for and the length of the policy term you require. Certainly, rates for a 30-year term policy will be higher than the rates for a 10-year term policy since the company is at risk for a longer period of time and they will have less time to collect premiums from the policyholder.

Lastly, the cost of your term life insurance policy will also be affected by the cost of any optional riders that you choose to purchase.

What are the Pros and Cons of Level Term?

Every type of life insurance policy or financial product has pros and cons. This typically has nothing to do with the insurance product itself but rather the needs of the policyholder.

In other words, level term life insurance is usually the best solution for an applicant looking to replace his or her income, but typically not a good solution for an applicant looking for lifetime coverage.

Knowing this, the pros and cons of level term life insurance are directly related to your need for insurance in the first place.

Purpose of the Policy | Pro | Con |

| Affordable coverage to pay living expenses of surviving loved ones | ✔ | |

| Affordable coverage to pay off debt and home mortgage | ✔ | |

| Save money for college tuition | ✔ | |

| Save money for retirement income | ✔ | |

| Leave a financial legacy for heirs or favored charity | ✔ | |

| Coverage needed on a temporary basis | ✔ | |

| Coverage needed for the life of the applicant | ✔ | |

| A senior applicant needing coverage for final expenses | ✔ | |

| An applicant is dealing with serious or multiple health conditions | ✔ |

Can Riders be used with Level Term Policies?

Although level term life insurance is typically purchased for the affordable death benefit, there are generally several riders available that can broaden the coverage and offer living benefits.

- Accelerated Death Benefit – This rider is one of the most popular because it provides for the insurer to advance the insured a large portion of the death benefit if the insured is diagnosed with a terminal, chronic, or critical illness. The advance will help the insured deal with the medical expenses that are associated with serious illnesses.

- Accidental Death Benefit – This optional rider allows the applicant to purchase an additional death benefit that will be paid if the insured’s death is the result of an accident.

- Disability Waiver of Premium – The waiver of premium rider provides for the insurer to waive the periodic premiums that become due if the insured person is totally disabled and cannot work.

- Child Term Rider – This rider allows the applicant to add term insurance on any unmarried dependent natural, adopted, or stepchildren to the insurance policy and is typically available for children aged 15 days to 25 years depending on the company.

- Guaranteed Insurability Rider – This optional rider allows the policyholder to purchase additional insurance coverage at a later date without having to go through medical underwriting. It is a great option for applicants who cannot afford the entire death benefit needed at application but they’ll have an option to add coverage later on without having to worry about health issues.

- Return of Premium – Even though the return of premium rider is rather expensive, it has gained in popularity over the years with young adults who are starting a family. This rider provides for the insurance company to return all of the premiums paid on the policy if the insured is alive when the policy expires. When the insured outlives the insurance coverage, he or she will receive a lump-sum payment from the insurer that is tax-free because it’s not considered income.

Alternatives to Level Term Life Insurance

As we discussed earlier, level term life insurance is not the best insurance solution for everyone. Even though term insurance is the least expensive life insurance product, price is not the best method for matching the product to the need.

There are many alternative insurance products available and your agent will be willing to help you select an insurance policy or policies that will best accommodate your circumstances and budget.

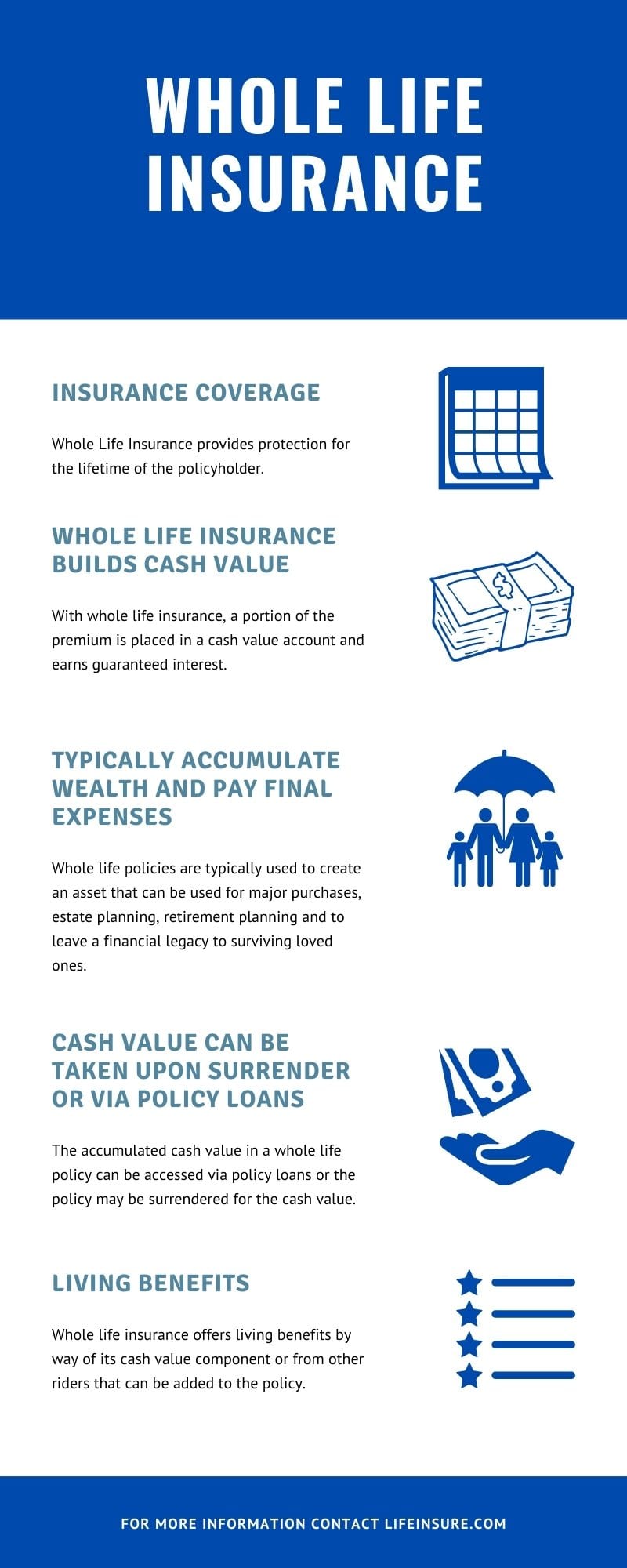

Whole Life Insurance

Since whole life insurance can provide lifetime coverage and contains a cash value component, it is the typical choice for individuals who want to accumulate wealth over their lifetime while at the same time, having a death benefit that can be left for loved ones.

All whole life insurance policies share the same features and benefits which are:

- Guaranteed coverage for life as long as premiums are paid

- Level periodic premiums that cannot be increased by the company

- A cash value account that accumulates over time and earns a guaranteed interest rate

Universal Life Insurance

Universal Life Insurance is another very popular insurance product because it can be used for many different needs. Many people think it is term insurance with a cash component but Universal Life is much more than that.

Although Universal Life (UL) is permanent insurance, the premiums are typically lower than whole life insurance and the policy is flexible as far as the premium and death benefit is concerned.

In most cases, the cash account in a universal life product will earn more interest than whole life insurance but both products are good solutions for retirement planning. One drawback to Univeral Life that Whole Life doesn’t share is that the death benefit in a UL policy is not guaranteed for a lifetime.

Both whole life and universal life also offer hybrid products that are designed for applicants who want to focus on wealth accumulation rather than the death benefit.

How to Select the right type of Level Term Policy

When you are considering which type of level term policy to purchase, there are three primary considerations to deal with:

- Amount of Coverage – Believe it or not, this is where most people get it wrong. Many applicants use a monthly premium for deciding how much insurance to carry than the actual needs that must be met financially if they should die unexpectedly. Deciding on the proper amount of coverage is critical when purchasing life insurance and should be discussed with an experienced agent who is willing to complete a needs analysis to help you see a realistic financial picture of what will happen if you die. Agents will not charge you for advice but rather earn a commission from the insurance company.

- Policy Term – Policy term is another aspect of purchasing term life insurance that many people get wrong because once again, they focus on the premium rather than the risk. For example, if you are in your 50s and approaching retirement, a 20-year term is more appropriate because of the savings versus a 30-year term and the fact that you’ll likely want to convert it to permanent insurance when you get into your sixties. Once again, focus on the need rather than the premium and take advantage of the advice from an experienced and reputable independent agent.

- Optional Riders – Although most companies offer the Accelerated Death Benefit rider at no cost to the applicant, the balance of available riders will increase the periodic premium.

Level Term Insurance Rates

Although most companies offer very similar types of level term life insurance, the rates vary considerably from company to company. With today’s technology, anyone looking to shop multiple insurance companies to find the best level term life insurance rates can easily use any comparative rater that can be found on thousands of life insurance websites.

Before you use a comparative rater, make sure you’re on an independent broker’s website and not an insurance company’s website. Don’t worry, the rates on the company’s site are not lower than the rates on an independent broker’s site.

Here is an example of the rates for a 20-year $500,000 Level Term Life Insurance policy for a very healthy male and female non-smoker:

What is very apparent when you view this rate chart is that level term life insurance is very affordable but the longer you wait, the more it costs. For an accurate rate for your actual age, please use our comparative rater at the bottom of the page.

Age Male No-Tobacco Female No-Tobacco

25 $18.53 $13.52

30 $18.87 $16.05

35 $21.25 $16.88

40 $29.17 $23.62

45 $47.21 $37.46

50 $71.54 $54.39

55 $114.82 $83.77

60 $199.06 $137.57

Frequently Asked Questions

Yes, and as a matter of fact, no exam term life insurance is only priced slightly higher than fully-underwritten life insurance but the companies that offer it generally cap the death benefit at \$1 million.

Typically, shortly before your expiration date, your insurance company will send you a renewal offer but the new monthly rate will be based on your attained (new) age and the policy term will be for one year (annually renewable term).

If your reason for buying direct is to save money, you’ll find that the rates when buying direct are very similar or the same as the rates you pay when you go through an agent. Additionally, insurance companies that sell directly to consumers have a limited product selection which would have an impact on your conversion option.

It means that this type of insurance has a fixed premium and face amount (death benefit) throughout the life of the policy. Your premium will remain the same and your death benefit will remain the same for the duration of the policy.

Term Life Insurance Quotes

SPEAK WITH A PROFESSIONAL

For more information about Level Term Life Insurance, call the insurance professionals at LifeInsure.com at (866) 868-0099 during normal business hours or contact us through our website.

Last Updated on July 17, 2024 by Richard Reich