NOTE: We are not Lincoln National Life Insurance. If you need to contact a Lincoln National representative,

you can call them at (219) 455-2000 during normal business hours or contact them through their website at LFG.com.

Lincoln National Life

1300 S. Clinton Street

Fort Wayne, Indiana 46801

Formed nearly 100 years ago, The Lincoln National Life Insurance Company (Lincoln) is the flagship of the Lincoln Financial Group family of businesses. The company markets retirement planning and wealth protection solutions, such as annuities and life insurance, through strategic partnerships with financial planners, broker/dealers, stockbrokers, and banks.

Lincoln Financial Group is a diversified financial services organization headquartered in Philadelphia, PA. Lincoln companies offer financial, retirement, and estate planning services and a variety of financial and investment products in four distinct business areas – insurance and annuities, individual and group retirement plans, mutual funds, and investment management.

In 1905, Robert Todd Lincoln, the only surviving son of the 16th President, Abraham Lincoln, gave us permission to use the Lincoln name at the founding of our flagship company, The Lincoln National Life Insurance Company. Since then, Lincoln has grown to become one of the largest, most enduring, and fiscally sound financial services organizations in the United States.

Today, with more than $100 billion in assets under management, we continue to serve the financial needs of our customers nationwide through brokers, planners, agents, and other intermediaries. Our goal is to provide clear and understandable financial information so our customers and their financial advisors have what they need to make sound financial decisions to meet their individual financial goals.

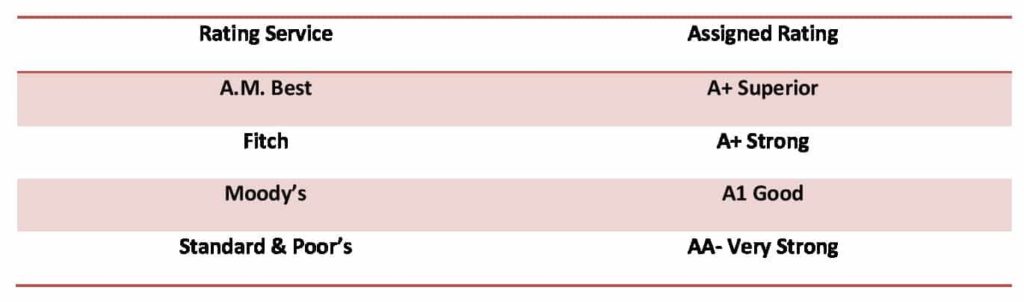

When you are considering doing business with an insurance company, it makes good financial sense to make certain that the company you are considering is financially stable and has a positive outlook for ongoing operations. The ratings for Lincoln National Life Insurance are as follows:

Circumstances and financial needs are different for most people. Knowing this, Lincoln National Life provides the insurance products necessary to protect families from unforeseen events. The company offers competitively priced products like low-cost term all the way to Variable products for consumers that ask for more than just a death benefit.

Lincoln National Life term products are best suited for individuals and families looking to purchase a large death benefit that can deliver the funds needed for living expenses, debt elimination, mortgage satisfaction, college funding, and final expenses when the policyholder passes away.

There are two Lincoln Term products to choose from

Lincoln TermAccel Level Term – This product is considered a simple issue product and has super-competitive rates for individuals under 50 years old that require face amounts of $1,000,000 or less. The company uses a simple phone interview application and provides fast processing that can deliver approvals in just a few days if no testing is required.

Lincoln LifeElements Level Term – Lincoln’s LifeElements product is targeted at individuals 30 years old and older who require a death benefit of $1,000,000 and above. This product also uses a telephone interview rather than the standard paper application so the applicant can be processed and approved as quickly as possible.

Accelerated Benefits – This rider provides for the insurance company to pay out a portion of the death benefit in the event you are diagnosed with a terminal illness that will likely result in your death within six months of the diagnosis.

Children’s Level Term – This optional rider allows the primary insured to provide coverage for all of his or her children.

Waiver of Premium – The waiver of premium rider provides for the insurance company to waive the periodic premiums of an insured who becomes totally disabled.

Lincoln National’s Universal Life Insurance provides all of the benefits of traditional insurance but includes the potential to accumulate significant cash value over time with a guaranteed interest rate.

Universal Life has the flexibility to accommodate the life events of the policyholder. The insured has the flexibility to set the monthly premium, change the death benefit, and take policy loans during the lifetime of the policy.

The Universal Life policy, when properly funded, will be permanent coverage for the life of the policyholder with all of the guarantees offered by traditional whole life insurance.

Lincoln offers several kinds of traditional Universal Life products, with each designed to provide coverage solutions to accommodate the applicant’s individual needs.

Lincoln LifeGuarantee® UL (not sold in NY)

This UL policy provides guaranteed insurance coverage for the life of the insured with level-guaranteed premiums.

Lincoln LifeCurrent® UL

Lincoln’s LIfeCurrent UL policy is designed to offer life insurance protection using their Coverage Protection Guarantee (CPG). The CPG is built into the base policy and included automatically. The CPC will run for up to 20 years or until age 90, whichever comes first. By using the CPG, policyholders can accumulate cash value and take advantage of the universal life insurance flexibility benefit.

Lincoln LifeReserve® UL

The LifeReserve® product is a universal life insurance policy that builds and accumulates cash value on a tax-deferred basis for the future use of the policyholder. The accumulated cash in the policy can be accessed through policy loans, partial surrenders, and full surrenders to the insurance company.

Lincoln LifeGuarantee® SUL (not sold in NY)

Lincoln’s LifeGuarantee® SUL is a survivorship universal life policy that is payable on a second-to-die basis and is guaranteed to remain in force to help with estate planning and family or charitable legacy.

Lincoln’s Indexed Universal life products are designed for those consumers who want life insurance protection combined with the ability to accumulate significant cash value that can be accessed by the policyholder for whatever reason they choose.

These policies pay additional interest when the market is up but contain a floor to protect earnings against a down market. There are currently three types of IULs to choose from: Lincoln WeathAccumulate®, LincolnWealthPreserve®, and Lincoln WealthPreserve® Survivorship.

For consumers who are looking to plan for retirement by growing their income while working or taking an income while retired, Lincoln Financial Group offers an assortment of annuity products that provide financial solutions to meet the individual needs of individuals and families.

Lincoln MYGuarantee Plus Fixed Annuity

The Lincoln MYGuarantee Plus fixed annuity is a single premium annuity that provides several features to help individuals and families meet their needs. It provides a guaranteed initial interest rate for 5 to 10 years with subsequent interest rates that will never be less than the minimum rate specified in the contract. Interest in the fixed account is credited and compounded on a daily basis.

Lincoln’s Fixed Indexed Annuities

Lincoln’s fixed-indexed annuities will allow the contract owner to protect savings while offering substantial growth potential because the interest rate is linked to the performance of a market index. Your funds are not directly invested in the market and are protected from market volatility. Lincoln Financial Group offers five types of fixed-indexed annuities:

If you are ready to take an income stream now, then an immediate annuity is your best solution. If, however, you prefer to start taking income at a later date, a deferred annuity will be the better choice. Lincoln Financial Group provides both types of annuities with their Lincoln Insured Income® Immediate Annuity and the Lincoln Deferred Income Solutions® Annuity.

Lincoln Financial Foundation awards grants to more than 300 nonprofits each year that empower and improve the lives of many. Contributing to strong, vital communities is not only intrinsic to their values, but they also feel it’s their responsibility.

For more information or free and confidential quotes from Lincoln National Life or any of the many other highly-rated carriers we represent, please use the quote form in the margin of the page, or call us at (866) 868-0099 during normal business hours on the west coast.

LifeInsure.com® is a registered

trademark of Intramark Insurance,

Services, Inc. © 2024.

Privacy Policy

Legal Notice & Disclaimer

Here is the legal information we’re required to provide you. LifeInsure.com, a California corporation and subsidiary of Intramark Insurance, is a licensed independent insurance broker. The information provided on this site has been developed by LifeInsure.com for general informational and educational purposes. We try hard to ensure that this information is up-to-date and accurate. Any insurance policy premium quotes or ranges displayed are non-binding. The final insurance policy premium for any policy is determined by the underwriting insurance company following application.