Call Now for Permanent Life Insurance Quotes

There are many different types of life insurance coverage available, each with its own set of benefits and drawbacks. Indexed universal life insurance (IUL) is one option that combines the flexibility of universal life with the potential for higher growth in the cash value account.

IUL gives policyholders the opportunity to benefit from positive stock market performance while limiting their downside risk. Whether or not IUL is the right choice for you depends on your individual needs and financial goals.

When shopping for life insurance, it’s important to understand all the different options available. Indexed universal life (IUL) policies are a popular choice, but they come with more complicated terms and conditions than other types of life insurance. Before buying an IUL policy, be sure to do your research and compare all the different fees and forecasts.

What is Indexed Universal Life (IUL)

Indexed universal life insurance is an excellent choice for permanent life insurance coverage. It offers a cash value account that accumulates tax-deferred and is tied to one or more stock indexes, such as the S&P 500. This provides greater potential for growth than other types of universal life insurance, which earn money based on market interest rates.

IUL offers many of the same benefits as a universal life policy, including flexible coverage and the ability to adjust premiums and death benefits. However, IUL also has some unique benefits that make it an attractive option for many people.

How Does IUL Life Insurance Work?

Indexed universal life insurance is similar to universal life insurance, but with some key differences. With indexing, your premium payments are based on an index, such as the S&P 500, which can help to maximize your investment growth potential.

Additionally, part of your premium payment goes toward the cost of insurance (covering your death benefit), while the rest is added to your cash account. This provides you with lifelong coverage and the opportunity to grow your investment over time.

Similar to Universal Life, IUL policies have an adjustable premium, which means that you can increase or decrease your payments at any time. This can be helpful in times of financial hardship, or when your needs change. Additionally, the death benefit on an IUL policy is also adjustable but you may have to go through the underwriting process depending on the company and amount of additional death benefit you require.

How Your IUL account Accumulates Wealth

The cash account in your policy earns money predicated on the performance of your selected stock index. A stock index, such as the S&P 500 or Dow Jones Industrial Average, is a way to track a group of stocks.

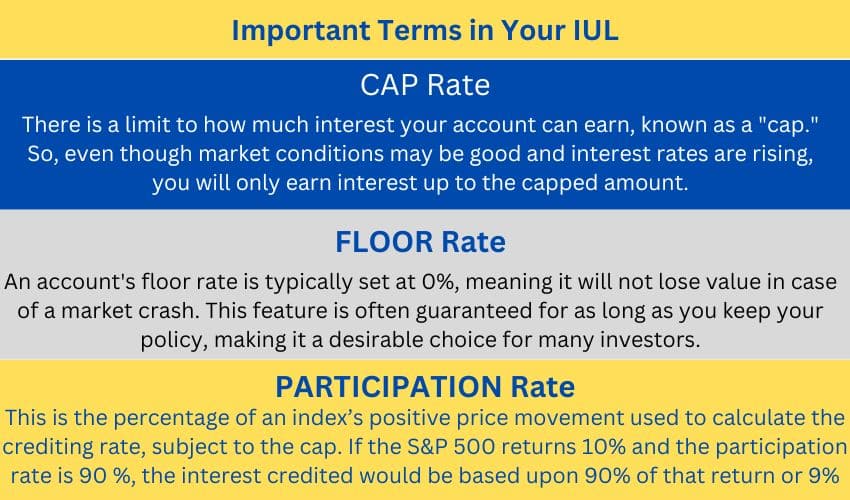

Insurance companies have one or more of these indices you can choose from. The insurer pays interest to policyholders based on the index’s performance subject to the policy Cap — as value goes up, the account earns interest.

However, if an index loses money your cash account is protected by the policy’s floor rate (typically zero or higher) which means your cash account will not lose money like a traditional investment account.

IUL Advantages and Disadvantages

Advantages

- You have complete freedom and flexibility when it comes to your death benefit and payments. You can increase or decrease them as you see fit, based on your needs and financial situation. You can also change the coverage amount at any time. However, you may need to complete a medical exam to increase the death benefit.

- IUL policies have the potential to provide greater returns than standard universal life or whole life policies as they are not restricted by fixed rates. Instead, IUL policy-holders can benefit from the growth of the overall market, allowing their cash-value account to build up over time. It’s like earning from the stock market without being in the stock market.

- Once your cash value account has sufficient funds, you can access that cash for any reason and pay it back when it’s convenient for you. The funds are a loan from the company that is collateralized using your cash account which continues to earn interest.

Disadvantages

- Although your policy will not lose value when your index underperforms, management and surrender fees will likely impact the value of your account.

- There is no guarantee on returns.

- Fees to consider: surrender charge, optional riders, administrative expenses, commissions, and premium expense charges.

Who Should Consider Indexed Universal Life Insurance

If you’re looking for inexpensive life insurance to replace your income and pay off debts and the family mortgage, an IUL policy is not likely the best choice for you. In these types of cases, Term Life Insurance would be a better fit.

However, if you’re looking for an investment product that can create significant wealth and provide a tax-exempt supplement to your retirement income from other investment products, an IUL can deliver that income and provide a death benefit for your surviving loved ones.

An IUL is a great way to fund your Life Insurance Retirement Plan (LIRP),

Conclusion

In conclusion, indexed universal life (IUL) insurance is a type of life insurance that offers some flexibility and a chance to grow money over time based on the stock market. Unlike regular life insurance, an IUL lets you earn more when the stock market does well, while still protecting your cash from big losses when the market drops.

However, IUL policies have a lot of details and extra fees, so it’s important to understand how they work and whether they fit your future goals. If you’re looking for a way to build savings while having lifelong insurance, an IUL might be a good choice, but it’s best to research carefully to decide if it’s right for you.

IUL Insurance FAQs

Indexed universal life insurance policies are a type of permanent life insurance that combines a death benefit with a cash value component that grows based on a market index’s performance, such as an equity index.

Indexed universal life insurance works by crediting interest to the cash value based on the performance of a selected market index. The policy may offer a guaranteed minimum interest rate, ensuring some growth even if the index performs poorly.

The pros of indexed universal life include flexibility in premium payments, potential for cash value growth linked to a market index, and a death benefit that can provide financial security for beneficiaries. Additionally, the cash value can be accessed through loans or withdrawals.

The cons of indexed universal life include potential caps on earnings from the index, fees that can reduce cash value growth, and the complexity of how interest is credited. Additionally, if not properly managed, the policy may lapse.

Indexed universal life insurance policies offer more flexibility in premium payments and potential cash value growth tied to market performance, while whole life insurance provides guaranteed cash value growth and fixed premiums. Whole life insurance is a permanent life insurance product with predictable growth, while indexed universal life can vary based on index performance.

Yes, you can access the cash value in your indexed universal life insurance policy through loans or withdrawals. However, it’s important to remember that borrowing against the policy may reduce the death benefit and cash value.

Indexed universal life insurance may not be suitable for everyone. It’s best for individuals who are looking for a permanent life insurance solution with growth potential in cash value, but it requires an understanding of how the indexed accounts work and the associated costs. Consulting with an insurance agent can help determine if it fits your needs.

Choosing the right index for your indexed universal life insurance policy involves understanding the different market indices available and how they have performed historically. Factors to consider include the index’s volatility, potential for growth, and any caps on earnings. Reviewing options with a knowledgeable insurance agent can provide valuable insights.

If you stop paying premiums on your indexed universal life insurance policy, the policy may lapse, which means you would lose both the death benefit and any cash value. However, if there is sufficient cash value, it may cover the cost of insurance for a while, but it’s essential to stay informed about your policy to avoid lapsing.

When shopping for indexed universal life insurance, consider factors such as the insurance company’s reputation, the specifics of the indexed accounts offered, the cost of insurance, and the policy’s fees. Additionally, compare different insurance offers to find the best life insurance policy for your financial goals.

Call Now for Permanent Life Insurance Quotes

Last Updated on November 4, 2024 by Sonny O'Steen