Retirees who are aiming to maximize their financial security may want to consider investing in variable annuities. This type of annuity offers the potential for higher returns associated with the stock market while also providing the safety of retirement income afforded by regular annuities.

Like most retirement accounts, you can customize your portfolio based on your goals when it comes to variable annuities. That does mean that more risk is involved but also that greater gains could potentially be made. Still, there is always the possibility of losing money even with these investments.

For individuals considering retirement planning, annuities are a common option. By paying in either a single lump sum or various installments, customers enter into contractual agreements with annuity companies or insurers.

As part of the agreement, these organizations guarantee income payments that reflect customer contributions and potential investment gains. The length of payment terms may range from mere weeks to lifetime coverage according to the specifics established by each respective contract.

There are three primary types of annuities to consider:

When investing in a variable annuity, the initial step is purchasing an annuity contract. You can do this by paying a lump sum to the company, transferring funds from another retirement account such as a 401(k), or with the option of smaller payments over time.

Once the contract has been issued, there are two options available – deferred and immediate variable annuities – which will need consideration and selection based on your individual needs and circumstances.

Instead of receiving payments immediately, a deferred variable annuity allows you to postpone them until further down the road. This type of annuity provides more time for the balance to accumulate rather than an immediate variable annuity, which requires payments right away upon enrollment and contribution of funds.

When it comes to investing funds, a variable annuity is an option that gives individuals the opportunity to put money into investment subaccounts. These subaccounts resemble mutual funds but are specifically tailored for annuities and they invest in a variety of assets such as stocks, bonds, and money market funds.

When picking an annuity, you will be presented with a list of subaccounts to choose from. This list will have information regarding the specific focus of each subaccount, such as whether it’s all stocks, bonds, or even a 50/50 mix. It is then up to you to decide how much of each should make up the overall portfolio.

In the 1950s, those seeking a different type of annuity were presented with the option of a ‘variable annuity’. Unlike fixed annuities that offer a predetermined return regardless of age, these offer fluctuating payments depending on several external factors.

Investors had the opportunity to benefit from potential gains in the stock market when they opted for a fixed annuity. These plans offered a selection of mutual funds issued by an insurer, so individuals could potentially earn higher returns while accumulating their savings and receive increased income during their retirement years.

When compared to fixed annuities, buyers of traditional investments face a major disadvantage – market risk that could lead to heavy losses. In contrast, insurance companies take on this burden when offering fixed annuities, guaranteeing whatever return was promised.

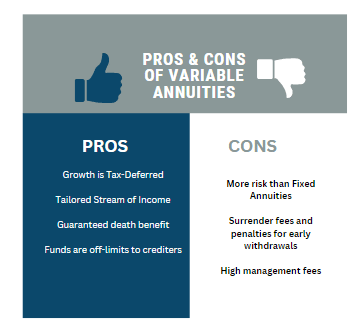

When deciding on any investment product like variable annuities, it certainly makes good financial to weigh the pros and cons to you can make an informed decision.

Additional benefits can be added to a fixed annuity at an additional charge called riders. One of the most popular is the Guaranteed Lifetime Withdrawal Benefit, which assures an income stream even when funds are low due to investment losses. Essentially, it guarantees a predetermined level of annuity payments for life, regardless of account size.

Other optional riders available from most annuity companies are:

When considering an annuity insurance company, one must take into account the fees that are associated with the different riders, investment management, and other extras. Typically, these charges range from 3% to 4% of the present contract value.

To give an example, a variable annuity of $500,000 in worth will see around $15,000 to $20,000 in expenses for this current year.

When investing in a variable annuity, you can be secure knowing that it includes a death benefit. Should the worst happen and you pass away during the accumulation period, beneficiaries will receive either part or all of your annuity’s value in a lump sum or subsequent payments over a period of time.

The death benefit usually amounts to the account value or the minimum guaranteed surrender value; whichever is greater.

Sadly, in the event of someone’s death, after they have begun to receive regular payments (annuitize), their designated recipients may get nothing or something depending on which annuitized income payout option was selected.

For those seeking extra security, variable annuity products offer an increased death benefit for an additional cost. This death benefit would provide guaranteed funds should the annuity run out of money.

Learning about and then choosing the right investment plan for your retirement can be confusing and frustrating. We invite you to speak with an insurance and annuity specialist on the LifeInsure team.

Feel free to call us at 866-868-0099 during normal business hours or contact us through our website at your convenience.