DISABILITY INSURANCE FAQs

This question is generally at or near the top of our list of Long Term Disability frequently asked questions and as such, let’s clear this up from start.

In most cases, you will not have a tax liability on your long-term disability benefits. However, there are exceptions to consider.

Key Article Takeaways

There are several things to consider when determining whether or not long-term disability benefits are taxable. The most important factor is how the premiums were paid. Usually, long-term disability premiums are paid with after-tax dollars. This means that the benefits received from a policy will not be taxed.

But, if your employer pays your long-term disability premiums for you and they do not include the amounts paid in your gross wages, your benefits from your disability policy will be taxable.

What if I’m a self-employed Freelancer?

Most self-employed individuals wrongly assume that they can deduct the premiums they pay for long term disability insurance but regretfully the IRS in their infinite wisdom does not allow a self-employed person to deduct their disability premium payments from their federal taxes.

For some reason, the IRS does not deem disability premium payments as a medical expense, Go figure.

Their thought process is simple even though it may seem unfair. The opinion of the IRA is that when you file a disability insurance claim, you are actually receiving lost income not payment for medical care.

What if I agree on a Lump-Sum Settlement from the Insurance Company?

Some long-term disability insurance companies may offer you the option to receive your benefits in one lump sum payment, rather than through intermittent payments. This would mean that you would receive your entire long-term disability benefit in one go. However, it is advisable to consult with a disability lawyer before agreeing to any such settlement.

When you receive a lump sum settlement, the tax consequences will depend on whether the payment is made with pre- or post-tax dollars.

Depending on the situation, a lump sum settlement may be taxable. This could result in a significant reduction of the total amount you receive after taxes are taken out.

How Long does it typically take before my Claim is Approved?

It typically takes around 45 days to receive an initial decision about your long-term disability claim. However, some claims may take up to three or four months to process. And remember the decision from the insurer may be denied.

Generally, there are a few factors that can affect how timely your claim decision may be:

Your elimination period. A waiting period, sometimes called a “vesting period” or “elimination period,” is the time between when you become disabled and when your long-term disability payments begin. This waiting period is common in insurance policies. You must be unable to work during this time in order to receive benefits at the end of the waiting period.

Contractual Deadlines. Disability claims can take different amounts of time to process depending on what type of insurance policy you have. Insurance policies have different deadlines for processing claims, so it’s important to know which timeline applies to your situation. ERISA disability plans offered through your employer are subject to federal law. As such, the insurer must adhere to the timeline set by the government.

According to the Employee Retirement Income Security Act (ERISA), disability claims must be processed and a decision issued within 45 days. However, there is a provision allowing two 30-day extensions, which means that claimants should expect to receive a decision on their ERISA disability claim within 105 days.

Individual disability insurance (IDI) policies are not subject to the Employee Retirement Income Security Act (ERISA). As a result, they may have different timelines and deadlines. Generally, an insurer must make a decision on a disability claim within a “reasonable” timeframe.

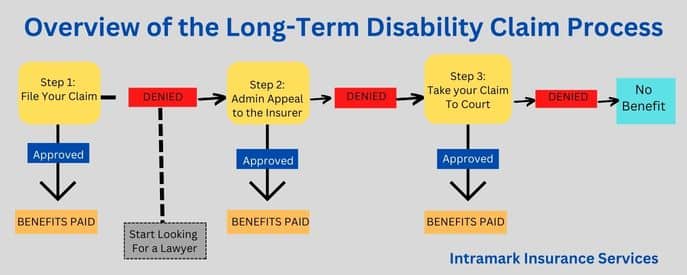

Appealing a Denied Claim. Appealing an insurance decision for an individual policy can be done in a couple different ways, though it may take much longer than the standard 90 days. One way to appeal is by filing with the insurance provider, or another option is to file a lawsuit in court. The process usually takes significantly more time than ERISA policies require.

Let Our Professional Team Get You Covered

At LifeInsurance.com, our insurance professionals deal with many of the highly rated insurance companies and will advocate on your behalf to deliver a the best solution to protect your income.

Feel free to call us at 866-868-0099 or contact us through our website 24/7.

DISABILITY INSURANCE FAQs

Frequently Asked Questions

If you paid you disability insurance premiums with after-tax dollars, you benefits would not be taxable.

Yes, you will be provided with a W-2 for every calendar year that you receive disability benefits.

Yes. If you have an ERISA LTD policy, yes. Social Security payments affect your long term disability in two ways. First, you may have to repay your long term disability carrier for any amounts received from Social Security. Second, your LTD benefits may be reduced by the amount you receive from Social Security.

Social Security Disability can stay active for as long as you’re disabled. If you receive benefits until age 65, your SSDI benefits will stop, and your retirement benefits will begin. In other words, your SSDI benefits change to Social Security retirement benefits.

Last Updated on August 19, 2024 by Richard Reich